Currency Trading

PRODUCTS

Trade Global Currencies with Direct Access to Interbank Quotes

The IBKR Advantage

- Tight spreads as narrow as 1/10 PIP

- Deep liquidity and real time quotes from 17 of the world's largest FX dealers

- 100+ currency pairs available

- Professional FX conversion tools

- Rated 5/5 stars Overall in the ForexBrokers.com 2025 Annual Review

- Low commissions, 0.08 to 0.20 bps times trade size, with no hidden spreads or markups

100+ Currency Pairs

IBKR Offers 100+ Currency Pairs On 28 Currencies

USD, AED, AUD, BRL, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, KRW,1 MXN, MYR,1 NOK, NZD, PLN, RON, SAR, SEK, SGD, TRY, TWD1 and ZAR .

Professional FX Conversion Tools

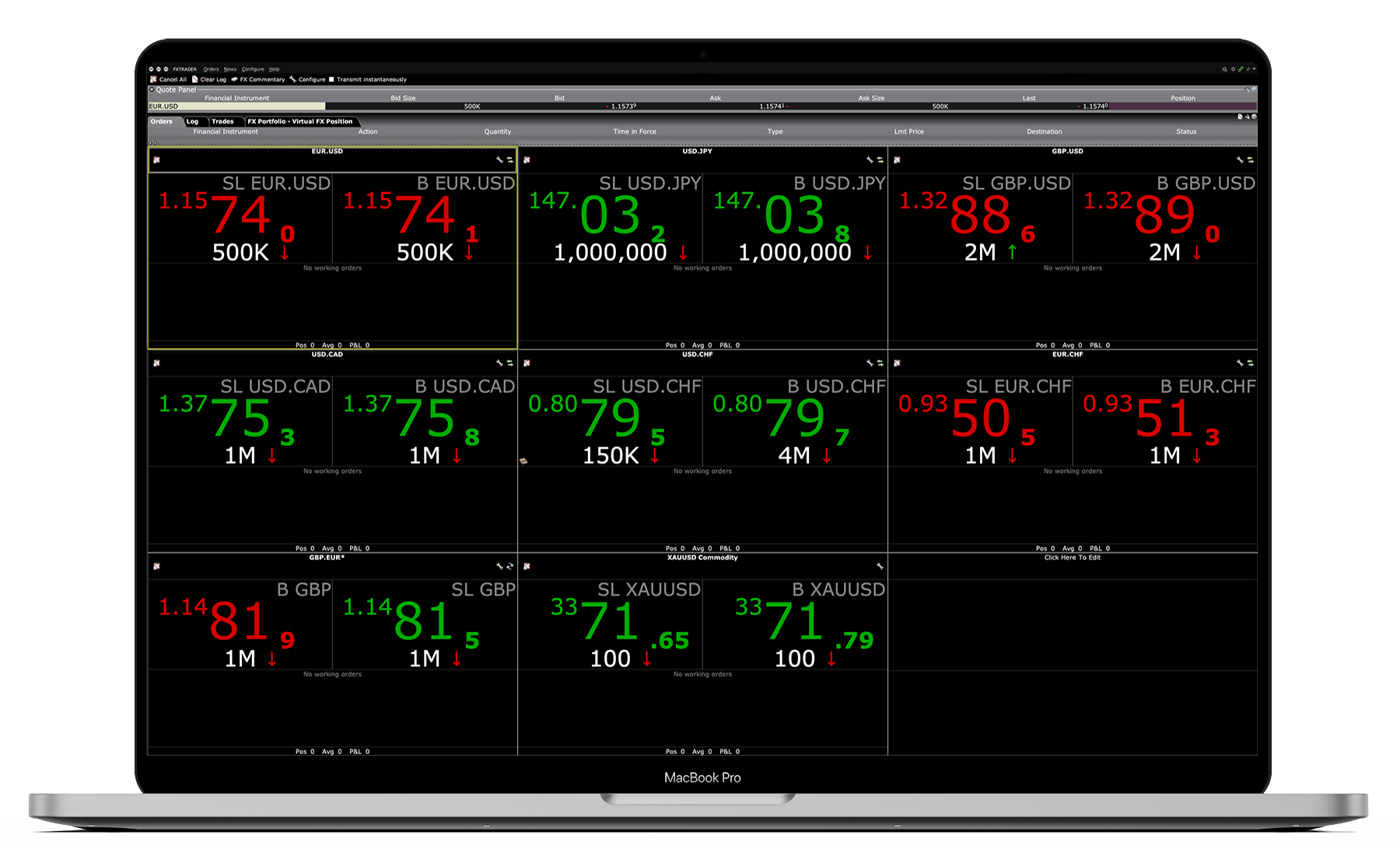

FXTrader

The FXTrader provides an optimized trading interface with tools built for the currency markets, including real-time streaming quotes, up and down indicators, trading volumes, pending trades, executions, positions, and average price plus P&L.

Manage FX Risk on Foreign Stocks

Trade stocks on overseas exchanges and attach an FX order to the equity trade to hedge the currency you want at the time of trade.

Large-Size Order Facility2

Large-Sized Order quotes are specific to the order quantity entered are generated based upon an aggregation of quotes provided by interbank dealers to help get the best execution possible and minimize market impact.

Interactive Brokers was rated 5 out of 5 stars Overall and

5 stars Range of Investments

Low Commissions

With No Hidden Spreads or Markups

0.08 to 0.20 bps times the trade size, with no hidden spreads or markups. Just the combination of tight spreads, as narrow as 1/10 pip, real time prices from 17 of the world's largest FX dealing banks and a transparent, low commission that avoids the conflict of interest of other brokers which deal for their own account.

What Are Currencies?

Currencies refer to foreign exchange (FX) transactions where one currency is exchanged for another at the current market price, also known as the FX rate. Settlement typically occurs within two business days. These trades involve currency pairs like EUR/USD or USD/JPY, where you are buying one currency and selling the other.

Key Features

- Real-time pricing based on supply and demand

- Fast settlement, typically in T+2 (trade date plus two days)

- Most common form of FX conversion for retail and institutional traders

Currency conversion is used by traders, businesses, and institutions to speculate, hedge, or manage international currency exposure.

How Do I Buy Currencies

For currency conversions, choose a regulated FX broker or multi-asset trading platform such as Interactive Brokers. When selecting a broker, consider the spreads charged by the broker since the spread is a strong indicator of the cost of each currency transaction, as well as fees and available currency pairs.

Spreads are typically measured in pips (short for “percentage in point”) and tight spreads, such as 1/10 a pip (also known as 1 pipette), may mean lower trading costs.

After selecting a broker, opening and funding your account, you will need to select currency pairs to trade.

- Major currency pairs include the US dollar and another widely traded currency such as the British Pound (GBP) or Japanese Yen (JPY). Major currency pairs typically have high liquidity, tight spreads and moderate market volatility.

- Minor currency pairs exclude the US dollar but include two major currencies, such as the Euro (EUR) or Australian Dollar (AUD). These currency pairs typically have lower liquidity than majors and slightly wider spreads, with market volatility usually dependent on the currency pair being traded.

- Exotic currency pairs involve a major currency, such as USD or GBP, and a currency from a developing or smaller economy, such as the Turkish Lira (TRY) or Mexican Peso (MXN). Exotic currency pairs typically have low liquidity and lower trading volume, wider spreads and greater volatility.

Once you decide on a pair, you would set up and execute your order, monitor your position, and either close your trade manually or allow it to settle automatically. Many brokers offer leverage, which allows you to control a large position with a small deposit. This can increase both profit potential and risk.

Benefits and Risks of Currency Conversions

Potential Benefits

Currency conversions offer several potential rewards, especially for active or globally-minded investors. One of the biggest advantages is the ability to profit from currency fluctuations by buying low and selling high (or selling high and buying back lower). Because the forex market is the most heavily traded financial market in the world, it offers exceptional liquidity, which means tight pricing and fast execution. The market is open 24 hours a day from Sunday evening to Friday evening (ET), allowing traders to participate across global time zones. Currency FX also offers leverage, giving traders the ability to control large positions with relatively little capital. This amplifies profit potential. In addition, currency conversion makes it easy to go long or short, so traders can profit in both rising and falling markets. It also provides a useful tool for diversification, whether to hedge other investments or take advantage of global economic trends.

Risks to Consider

Currency conversion involves substantial risk. While leverage can increase profit potential, it also magnifies losses. Small market moves can quickly result in large account drawdowns. Forex prices are extremely sensitive to news and macroeconomic events, and volatility can spike without warning. Many traders also face emotional challenges such as overtrading, impatience, or poor decision-making during fast-moving markets. Since trades are conducted through brokers rather than exchanges, there is some counterparty risk, especially with unregulated or offshore platforms. Additionally, if a trader holds a position overnight, rollover interest charges or credits may apply based on the currencies involved.

Interactive Brokers’ Education and Resources for Currencies

Traders' Academy

Traders Academy offers a full course on currencies called Introduction to Forex. Lessons include Introduction to the FX Market, FX Rates and Drivers, Pairs & Major Currency Products and a Case Study on FX Stock Trades.

Traders' Insight

Traders’ Insight provides market-related articles and commentary from Interactive Brokers’ employees, exchanges and third-party contributors.

Start trading like a professional today!

Open AccountDisclosures

There is a substantial risk of loss in foreign exchange conversion. The settlement date of foreign exchange conversion can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange conversions. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Currencies available for trading vary by Interactive Brokers affiliate.

- With special conversion functionality.

- Please contact Client Services or your IBKR Sales Representative to see if you qualify for the Large-Size Order Facility (generally orders over 7M USD or equivalent).